Data is everywhere and Data Science is the key to unlocking its power. Anytime you are browsing Amazon or watching the newest show on Netflix, you are generating data ready for analysis. Taking your cell phone with you allows Google to estimate traffic delays. These companies are leveraging Data Science to optimize their businesses. Because of this they are able to deliver a better product.

The opportunity is for finance departments to step up their game and incorporate Data Science into their decision making. Large organizations have whole departments dedicated to analytics. Small to medium-sized businesses are lucky if they have one person who can do this type of work. Data Science can enhance financial analytics as it has in other arenas.

What is Data Science?

Data Science is a hot field these days, but it isn’t new. Companies have been using spreadsheets and databases for years to analyze their business . It may not seem sexy, but Microsoft Excel is the most widely used analytics tool in corporate America. Today the only difference is the volume, variety and velocity of the data; this is known as “Big Data”. Now where is the cutoff point between “big” and “small” data? Who knows. I’ve worked at companies that have used thousands to a billion rows of data. I imagine it’s somewhere in the middle.

Data Science is a method to drive smarter decisions. The framework is made up into four parts:

- Statistician – expertise in statistical analysis helps identify patterns in data and optimize machine learning algorithms.

- Technologist – leverages programming to pull data (e.g. SQL), analyze large volumes of data and productionize code (e.g. R or Python).

- Business Expert – places data learnings in business context and better understands the interaction between data elements.

- Story Teller – communicates complex findings in simple terms that allows the business to make actionable recommendations.

Practical Data Science

The business application of Data Science extends to every facet from marketing to operations and yes, finance. Consider the following application:

A company relies on a print catalog for the bulk of its orders. In the past, they acquired a list of 1,000,000 names and addresses and sent a catalog to every person. On average, only 2,000 of those recipients became customers (a paltry 0.2% rate). Using Data Science, a predictive algorithm looks decides which people have the highest likelihood of making an order. With that data, the business can decide how many catalogs it sends out. Therefore, Data Science minimized expenses while maximizing revenue.

Smarter Forecasting and Budgeting

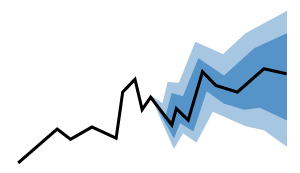

Finance departments show what future months, quarters and years look like given a set of assumptions. So many times I have been asked the following question: what would sales look like if we change x, y and z? Typically a single number is spit out like $48.9MM. The best way to approach this question is to rather ask: what is the likeliest range of sales?

A range of values informs the business on what worst case and best case look like. This technique is often employed by Wall Street analysts, but rarely in smaller businesses.

The solution is to have the business provide ranges for the assumptions. The analyst can build a simulation and run it thousands of times to get a distribution of estimates. This provides the business with best and worst cases to plan for. A dynamic model will update with new information, eliminating the need for a drawn out annual budget process.

Data Transparency with Business Intelligence

If a picture is worth a thousand words, a graph is worth a million data points. It’s easy in finance to rely on tabular reporting to display data, but it’s more effective to use visualizations to convey the message. One graph can convey the same information in a few seconds that would take minutes, if not longer with a report. Just avoid these mistakes.

Business Intelligence (BI) tools (think Tableau or PowerBI) puts data directly in the hands of management. Once an analyst sets up a report or dashboard, decision makers can use at their leisure. This expedites the relay of information. A side benefit is finance can focus more on analysis and less on reporting.

Great dashboards not only provide data, but they also cause the viewer to ask questions. These questions reveal potential issues faster. Fast identification of inefficient operations reduces service interruptions and ultimately lost revenue.

The Merger of Finance and Data Science

Data Science skills have been scattered across organizations. Because data is now ubiquitous, it’s time for finance departments to leverage those skills to enhance their value.

The amount of data is increasing every day. Financial analysts need more skills to use data in the most effective way possible. Finance departments need to add Data Science skills or partner with professionals who can do both. The influx of data is a huge opportunity and companies that don’t enhance their decision making with analytics will fall behind.