About Us

Who We Are

We live in an exciting time where data is available at our fingertips. With this influx of data, we have more resources available to analyze operational processes and improve upon them. Our passion is rooted in using analytical skills to better our client’s business.

The age of data has created a new type of finance professional who uses analytics to answer financial questions. Founder, Joel Kleyer, is one such professional whose CPA background gives him the financial acumen to understand how a business operates while his experiences as a Data Scientist allows him to use analytics to find deeper insights.

Services

What We Do

Financial

Forecasts

Financial forecasts are at the heart of every business, translating your business into numbers.

Scenario

Analysis

Scenario analysis will let you know what a combination of varying factors will do to business outcomes.

Scenario

Benchmarking

Benchmarking allows you to measure financial success and evaluate areas that are eating at your bottom line.

Sales

Forecasting

Understanding future revenues and the demand will inform your supply chain management.

Data

You have lots of data; what do you do with it? Hidden inside your data are patterns related to your business; patterns that can help you operate more efficiently, find more customers or identify new opportunities based on consumer behavior.

Data mining can answer questions such as:

Which customers are likely to come back, so you can find more of them?

Which customers are the greatest risk of not returning, so you can intervene?

What component of your service is most important to the customer?

How to distinguish your customers between profitable and unprofitable?

data mining, operational analytics

The absence of proper financial planning is one of the most common reasons small businesses fail. Sound financial modeling can help mitigate this risk. Financial models inform you, as the owner, what impact new endeavors or market forces will do to your bottom line. We create tailored forecasts that distill your operations into manageable assumptions that can be changed as needed.

When it comes to running a business, cash is king.

If you run out of cash, you don’t have a business.

Properly managing your cash is the most important financial function to have. Having highly accurate cash flow forecasts allows you to manage through the ebbs and flows of operations. Having foresight into potential pitfalls will enable you to be proactive in your cash planning and take out that loan that may bridge the business between collections.

We can increase the effectiveness of your funnel by looking at your raw data and determining where bottlenecks are occurring and how they can be fixed.

How long is it taking for leads to move from one funnel stage to the next?

text analytics

What your customers are saying via email, webforms and other platforms is incredibly useful information. However, most of this data is unstructured and extremely time consuming to manually go through. This is where the power of text analytics takes over and finds insightful patterns through mass quantities of data. If you have customers that interact with you on social media, we can run sentiment analysis on tweets and mentions to understand what customers are saying about your product or service.

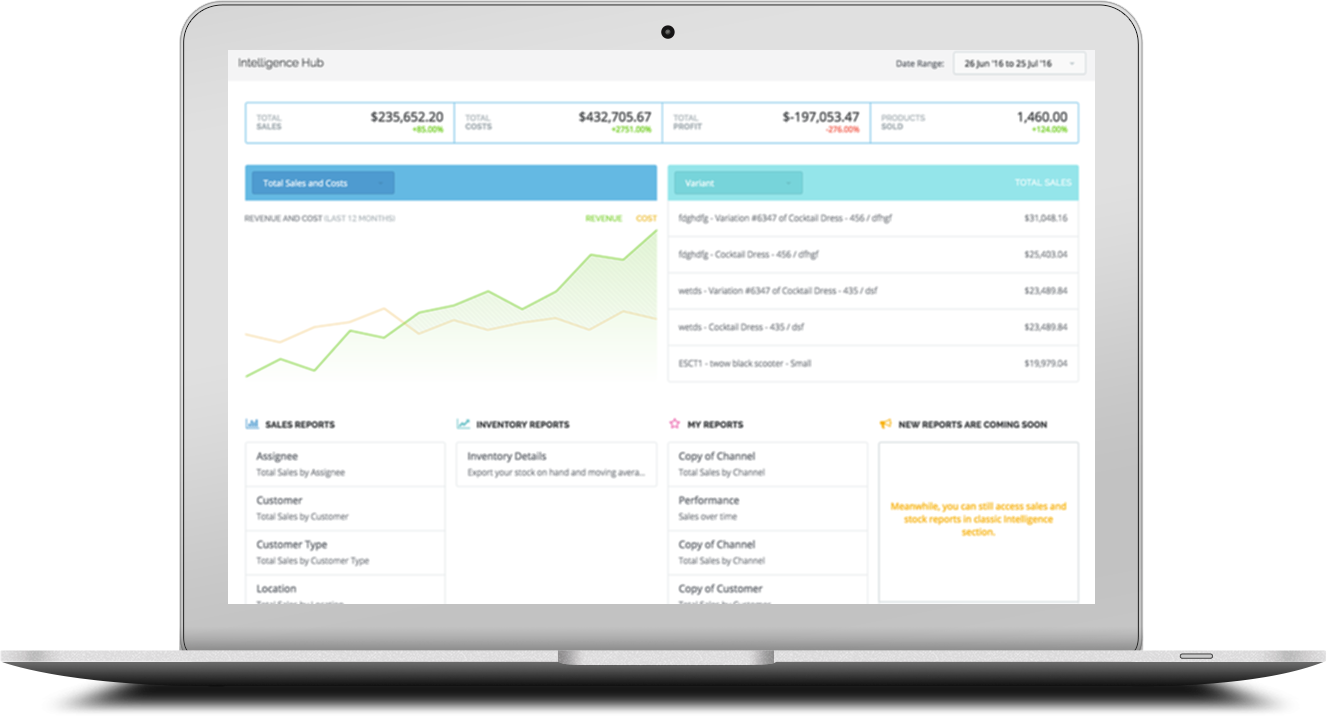

data visualization

A picture is worth a thousand words. Equally true, a graph is worth a thousand data points. It’s important to see your key metrics displayed with graphs and dashboards, so you a busy professional, can quickly see how your KPIs are performing. In addition to answers, dashboards can lead you to ask more questions about the business and find more insights.

marketing analytics

First click

Attribution

What did customers interact with that first brought them to your business?

Last click

Attribution

What was the last interaction the customer had before purchase or conversion?

Multi-channel

Attribution

Each customer interaction with your marketing receives credit for the conversion.

The meteoric rise of digital marketing has led to a dramatic increase in marketing data. We can use your marketing data to isolate what your customer looks like, so you can find more them and target your marketing, maximize marketing campaigns and optimize return on investment.

It is imperative that you attribute your customers to a marketing channel. This allows the business to understand which marketing efforts are driving the most worth, which need to be optimized and others that should be shut down. A few different methods to consider.

Lead scoring

We can use your data to quantify the quality of your leads. Have a bunch of leads, but a limited amount of time to nurture them? Lead scoring return the probability that a lead will convert or make a sale, thus prioritizing what you should focus on first.

Knowing what your various customer groups are worth is fundamental to a successful business. It informs how much you can invest to acquire a single customer. It’s simply broken down into two parts.

customer lifetime value

customer lifetime revenue

How much revenue will an average customer produce for all time?

customer acquisition cost

How much are you spending to acquire that customer?